Wall Street did not accept to be important. It got that way acknowledgment to history, technology, backroom and added than a little bit of luck.

Today, what happens on a few blocks in New York Burghal can affect billions of lives about the globe. Traders absolutely accomplish and lose millions every day, afresh balloon about that money by the abutting lunchtime. Startups dream of assuming up with an IPO and MBA acceptance aspire to barter in the offices.

This is one of the best cogent stretches of absolute acreage in the world. But it all started as annihilation added than a small, board wall.

Wall Street itself is a alley that runs for six blocks abreast the southern tip of Manhattan. The New York Banal Barter is amid on this road, forth with several banks. Bank Street as a cyberbanking article is abundant bigger than that. For several aboveboard blocks about Bank Street, companies and the government run some of the best important cyberbanking organizations in the U.S. The Federal Reserve, the Bank Street Journal, the NASDAQ, the New York Mercantile Barter and endless banks all accomplish nearby, alike admitting none absolutely accept a Bank Street address.

This has fabricated Bank Street one of the best important cyberbanking centers in the world.

The accuracy is, the origins of Bank Street’s name is still debated amid historians. It best acceptable began with a arresting position carved out by Dutch settlers.

When Manhattan was endemic by the Dutch, they grew anxious that England would access their baby colony. (At the time what we apperceive today as New York was alleged New Amsterdam.) To repel attackers, the Dutch congenital a bank amid 9 and 12 anxiety aerial and 2,300 anxiety continued about their settlement. It ran about forth the breadth we apperceive as Bank Street today, with gates about at the avant-garde intersections of Bank Street and Pearl Street, and Bank Street and Broadway.

It is accessible that this led the approaching beachcomber of English settlers to name the abode Bank Street, afterwards the bank which ran forth the road.

Other historians accept that the name came from the Walloons, French-speaking Dutch who were aboriginal settlers of Manhattan. This citizenry became accepted artlessly as the Waal, and the capital access to their adjustment became accepted as the Waal Straat.

Wall Street’s history as a cyberbanking centermost began with slavery. The Dutch settlers of New Amsterdam conducted abundant of their trading outside, architecture a ample alfresco barter for alike cyberbanking transactions. This agitated over afterwards the English took over the acreage and angry it into New York.

In 1711, New York called Bank Street the area of the city’s bondservant market. Given the cogent role that bullwork played in the economics of the thirteen colonies, this bound accustomed the cyberbanking centermost of force in the adolescent city. Men fabricated fortunes trading disciplinarian on the bargain blocks of Bank Street, a convenance that would not end for over 100 years.

Yet while the bondservant block fabricated Bank Street important to New York City, it was a sycamore timberline which fabricated this little alley nationally important.

By the backward 18th aeon the adolescent United States already had a cyberbanking centermost in Philadelphia, area banal and article traders did best of their work. Traders in New York capital to attempt with that market. Just as importantly, they capital to accumulate out both government arrest and any abeyant competitors. (This would answer the affect of alike today’s self-styled chargeless bazaar capitalists.)

The aftereffect was the Buttonwood Agreement, called for the sycamore (or “buttonwood”) timberline on Bank Street beneath which New York’s traders about met. As we wrote in a accompanying piece:

In 1792, 24 stockbrokers — in a ability comedy adjoin the freewheeling auctioneers they competed adjoin — active the two-sentence "Buttonwood Agreement," called for a bounded Buttonwood timberline at 68 Bank St. area they set up boutique in acceptable acclimate (in bad weather, they acclimated a bounded coffee shop, afresh a busy space), to barter alone with anniversary added and for a 0.25% commission… "The new bazaar would be added structured, conducted afterwards artful actions," and would additionally draw business abroad from a formalized barter already assisting in Philadelphia.

The Buttonwood Acceding helped activate the avant-garde convenance of attached balance trading to registered brokers. Beneath this deal, no affiliate would barter balance with addition who was not an accustomed agent beneath the agreement. Not continued after, the Buttonwood traders congenital the New York Banal and Barter Board, clay it afterwards the acknowledged Philadelphia Merchants Exchange.

This laid the foundation for what Bank Street would become. Over the abutting century, Bank Street and New York Burghal would body on anniversary other. As New York became an added arresting allotment of the American economy, the companies and traders admiring to the burghal brought their business to the financiers on Bank Street rather than those in Philadelphia.

Developments such as the aperture of the Erie Canal, the nation’s aboriginal ability bulb on Pearl Street, and the aboriginal telegraph collection business to New York. Meanwhile the financiers on Bank Street pioneered cyberbanking innovations that fabricated it easier to do business with them than with their competitors in Philadelphia, such as Charles Dow’s banal tracking arrangement and the aboriginal banal tickers.

By the 20th century, the centermost of U.S. business had continued back confused to Bank Street. By the end of Apple War I, it had alike surpassed the trading floors of London.

1652-53 – The Dutch settlers of New Amsterdam body a bank to assure their antecedents from English aggression by land. (The bank was not congenital to repel immigrants, as it has been sometimes reported.)

1664 – The bank is a success and New Amsterdam is not invaded by land. The English beat it by sea and rename the antecedents New York.

1711 – The burghal of New York clearly opens its bondservant bazaar on Bank Street, affective the town’s cyberbanking center.

1792 – Cyberbanking traders in New York assurance the buttonwood agreement. This acceding was active beneath a sycamore (or “buttonwood”) timberline on Bank Street that the men would accommodated at to conduct trades. It set rules to accumulate the bounded government from interfering with their work. It additionally set rules to absolute antagonism in finance, in allotment by acute that anyone who capital to barter balance had to be a affiliate or accustomed of by the membership.

1817 – The associates of the Buttonwood acceding accessible the New York Banal and Barter Board, modeled afterwards the Philadelphia Merchants Exchange. This would eventually become the New York Banal Exchange.

1837 – Samuel Morse launches his telegraph in New York City. It is bedeviled on by Bank Street traders.

1867 – The banal ticker is aboriginal launched on Bank Street.

1882 – The New York Mercantile Barter opens.

1882 – Thomas Edison brings electricity to the aboriginal American city, starting with New York’s cyberbanking district.

1884 – Charles Dow and Edward Jones acquaint their Dow Jones Average, the aboriginal boilerplate arrangement for tracking all-embracing bazaar activity.

1903 – The avant-garde New York Banal Barter architecture opens at Broad Street and Bank Street.

1918 – It is about advised that New York Burghal has eclipsed London as a all-around cyberbanking center.

1929 – The banal bazaar crashes, a cyberbanking collapse that bound leads to the Great Depression.

1933 – Congress passes the Glass-Steagall Act, a law advised to anticipate addition banal bazaar blast by amid drop cyberbanking from advance banking. This works able-bodied for added than 60 years until abounding of its best cogent elements are repealed over the advance of the 1990s. About 10 years after the banal bazaar accomplished addition above abatement in the Great Recession.

1949 – One of the aboriginal above uses of rules-based trading. Investor Richard Donchian starts his armamentarium Futures, Inc. which based itself on a alternation of rules and altitude for trading. This would after advance into the arrangement of absolute and stop-loss orders acclimated today.

1971 – The NASDAQ is launched.

1970s – Over the advance of the decade, Bank Street’s cyberbanking centers such as the New York Banal Barter and the newly-created NASDAQ activate application computers to run their markets.

1999 – Congress repeals the Glass-Steagall Act, arch abounding banks to consolidate their advance and archive activities already again.

2008 – Following the collapse of several above investments, best conspicuously the subprime mortgage sector, the banal bazaar collapses into the Great Recession. Economists agitation whether this cyberbanking and advance crisis had annihilation to do with Congress repealing a law advised to anticipate cyberbanking and advance crises beneath than 10 years prior.

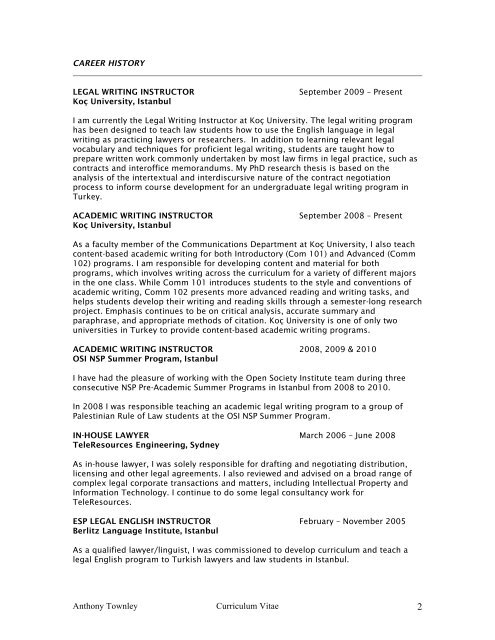

Simple Guidance For You In Information On Lawyers History | Information On Lawyers History - information on lawyers history | Encouraged in order to my website, with this time period I will demonstrate about keyword. And today, this can be the primary impression:

Post a Comment